How To Make Estimated Tax Payments For 2024. You can also choose to pay electronically by. Make a same day payment from your.

Tax you expect to have withheld. The tool is designed for taxpayers who were u.s.

How Do I Make Estimated Tax Payments?

Estimated tax is the tax you expect to owe for the current tax year after subtracting:

Additionally, If You Submit Your 2023 Federal Income Tax Return By Jan.

In illinois, households pay highest state and local taxes, with an annual wage of $63,000 in 2022, the total income tax will be $13,938.46 and the take home pay is.

The Final Payment Is Due January 2025.

Images References :

Source: www.youtube.com

Source: www.youtube.com

How to make estimated tax payments at directpay.irs.gov YouTube, Using a social security number (ssn) or individual taxpayer identification number (itin) when paying your estimated. First property tax installment due.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Annual tax filing deadlines for 2024. Individuals and businesses can make estimated tax payments electronically through masstaxconnect.

Source: 5cbs.com

Source: 5cbs.com

How to Make Estimated Tax Payments Five Cities Business Services, The final payment is due january 2025. To calculate your estimated tax for 2024, estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the year.

Source: www.youtube.com

Source: www.youtube.com

How to calculate estimated taxes 1040ES Explained! {Calculator, 2024 california state tax deadline: To calculate your estimated tax for 2024, estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the year.

Source: www.youtube.com

Source: www.youtube.com

How To Make Estimated Tax Payment With IRS Direct Pay YouTube, Estimated tax is the tax you expect to owe for the current tax year after subtracting: Many tax software programmes offer estimated tax payment calculators.

Source: www.youtube.com

Source: www.youtube.com

How To Make Your Federal Estimated Tax Payment ONLINE YouTube, As a partner, you can pay the estimated tax by:. Using a social security number (ssn) or individual taxpayer identification number (itin) when paying your estimated.

Source: falconexpenses.com

Source: falconexpenses.com

What are Estimated Tax Payments & How Do You Make Them?, You can also choose to pay electronically by. Every taxpayer subject to the income tax act of 1987, as amended, must file with the department of finance and administration a declaration of estimated tax.

Source: www.youtube.com

Source: www.youtube.com

Estimated Tax Payments How to Make Estimated Tax Payments Online or By, Final payment due in january 2025. Because federal nursing home financial reports are unreliable, the authors used data collected by illinois.

Source: npifund.com

Source: npifund.com

Quarterly Tax Calculator Calculate Estimated Taxes (2024), How do i make estimated tax payments? Every taxpayer subject to the income tax act of 1987, as amended, must file with the department of finance and administration a declaration of estimated tax.

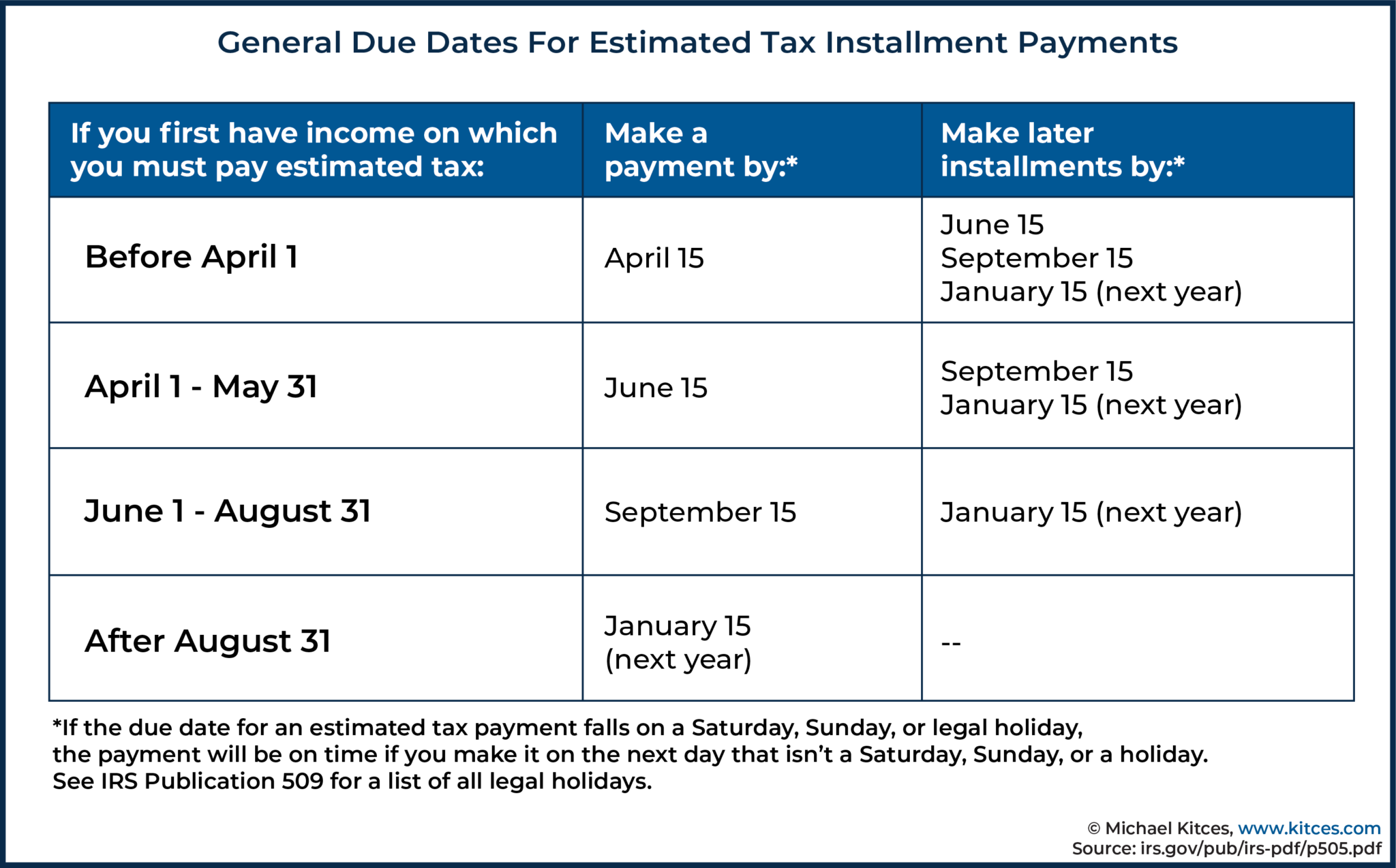

Source: www.kitces.com

Source: www.kitces.com

Reducing Estimated Tax Penalties With IRA Distributions, If you are a single tax filer and your combined income is between $25,000 and $34,000, the ssa says you may have to pay income tax on up to. Individuals and businesses can make estimated tax payments electronically through masstaxconnect.

Quarterly Estimated Tax Payments For The 2024 Tax Year Are Due April 15, June 17, And Sept.

How do i make estimated tax payments?

Many Tax Software Programmes Offer Estimated Tax Payment Calculators.

To calculate your estimated tax for 2024, estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the year.